Earlier in 2018, the British Columbia government announced plans to abolish the existing Medical Services Plan (MSP) premiums. While some BC employers already pay the MSP on their employee’s behalf, there are still many employees who are left to remit those expenses on their own. Indeed, BC is the only province to maintain MSP fees in the last decade. The new Employer Health Tax will move that responsibility to the employer – bringing it in line with standard payroll tax in other provinces such as Ontario, Quebec, and Manitoba.

At up to 1.95%, BC’s EHT will match Ontario in having the lowest EHT rates. Those companies that outsource their payroll to a payroll service, or even a staffing service, will need to review how the new EHT will be reflected in the service fees billed by those firms to their client companies.

THE KEY DETAILS

WHEN DOES THIS TAKE EFFECT?

The new tax takes effect January 2019. Registration for companies begins January 7, 2019, and the first employer health tax returns are due on March 31, 2019.

WHO IS AFFECTED?

The health tax applies to all employers with BC payroll:

“This Bill imposes a tax, effective for the 2019 calendar year, on the remuneration paid by employers to or on behalf of employees that report for work in British Columbia.”

Small businesses, charitable organizations, and non-profits will have special considerations or exemptions.

HOW MUCH WILL THIS COST?

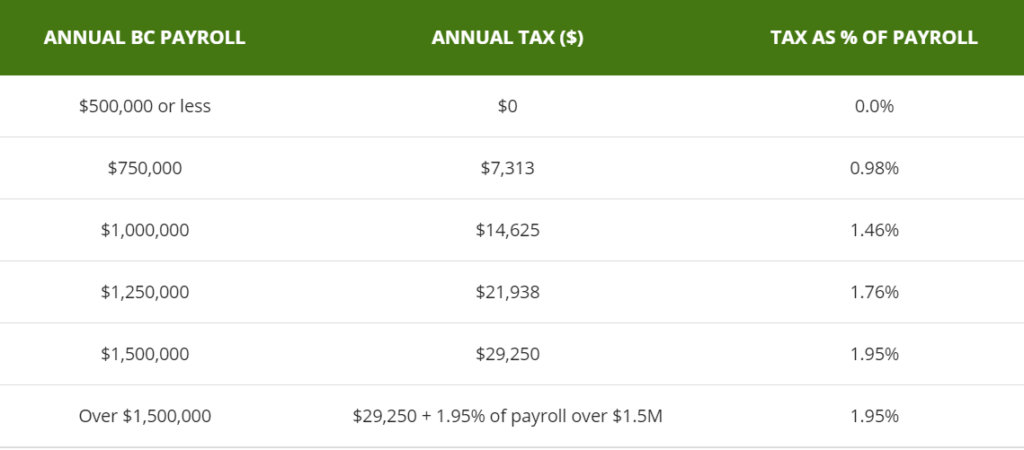

The EHT rate will be determined by the size of the employer’s payroll and the type of employer classification:

The EHT rate will be up to 1.95% (unless the company is a non-profit or charity):

“Subject to the provisions of the Bill that provide otherwise, the tax is paid at a rate of up to 1.95% of the BC remuneration paid by the employer during the calendar year. If the remuneration paid by the employer is less than $500 000, no tax is payable.”

- “While the EHT applies across sectors, non-profits will benefit from location and threshold rules similar to other jurisdictions.”

- Small businesses will be exempt: Employers that have payroll under $500,000 will be exempt, and those between $500,000 and $1.5 million will pay a reduced rate. Less than 5% of BC businesses will pay the full EHT rate of 1.95%.

Credit: Western Compensation & Benefits Consultants.

BE PREPARED FOR THE NEW EMPLOYER HEALTH TAX

All employers above the exemption amount need to register for the employer health tax. Registration begins January 7, 2019. If you must pay installments in the 2019 calendar year, you must register by May 15, 2019 and pay your first installment by June 15, 2019. All other taxable employers must register by December 31, 2019. You must file and pay your first return by March 31, 2020.

ABL is a staffing agency specializing in filling general labour temporary jobs, including packaging jobs and warehouse jobs. Contact us today to find the right staff for your needs!

You might also like:

- Preparing for Rising Minimum Wages in British Columbia

- Trump’s Trade Tariffs: What’s the Impact on Canadian Manufacturing Companies?

- Smart Strategies to Solve Your Forklift Operator Shortage