As part of ABL’s Occupation Wellness Management program, it is important to work towards financial health which we primarily do this by working.

If you have received a tax refund in Canada and want to use it to reduce financial stress, there are several ways you can make the most of that money. Here are some suggestions:

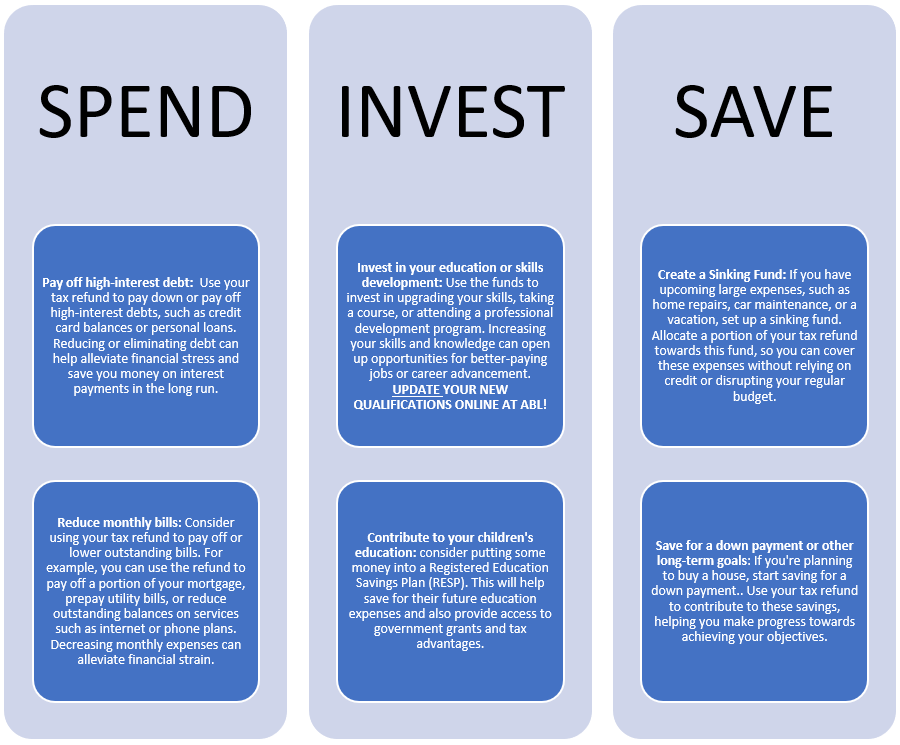

- Pay off high-interest debt: Use your tax refund to pay down or pay off high-interest debts, such as credit card balances or personal loans. Reducing or eliminating debt can help alleviate financial stress and save you money on interest payments in the long run.

- Reduce monthly bills: Consider using your tax refund to pay off or lower outstanding bills. For example, you can use the refund to pay off a portion of your mortgage, prepay utility bills, or reduce outstanding balances on services such as internet or phone plans. Decreasing monthly expenses can alleviate financial strain.

- Invest in your education or skills development: Use the funds to invest in upgrading your skills, (such as with ABL’s online training library here and here), taking a course, or attending a professional development program. Increasing your skills and knowledge can open up opportunities for better-paying jobs or career advancement. UPDATE ABL WITH YOUR NEW QUALIFICATIONS BY TEXTING YOUR LOCAL ABL BRANCH SERVICE OFFICE

- Contribute to your children’s education: If you have children, consider putting some money into a Registered Education Savings Plan (RESP). This will help save for their future education expenses and also provide access to government grants and tax advantages.

- Create a Sinking Fund: If you have upcoming large expenses, such as home repairs, car maintenance, or a vacation, set up a sinking fund. Allocate a portion of your tax refund towards this fund, so you can cover these expenses without relying on credit or disrupting your regular budget.

- Save for a down payment or other long-term goals: If you’re planning to buy a house, start saving for a down payment.. Use your tax refund to contribute to these savings, helping you make progress towards achieving your objectives.

Remember, it’s essential to evaluate your unique financial circumstances and prioritize your specific goals when deciding how to spend your tax refund.